Oil’s Financials are Falling Apart

28 Jul 2025Hydrocarbons borrow energy from the past

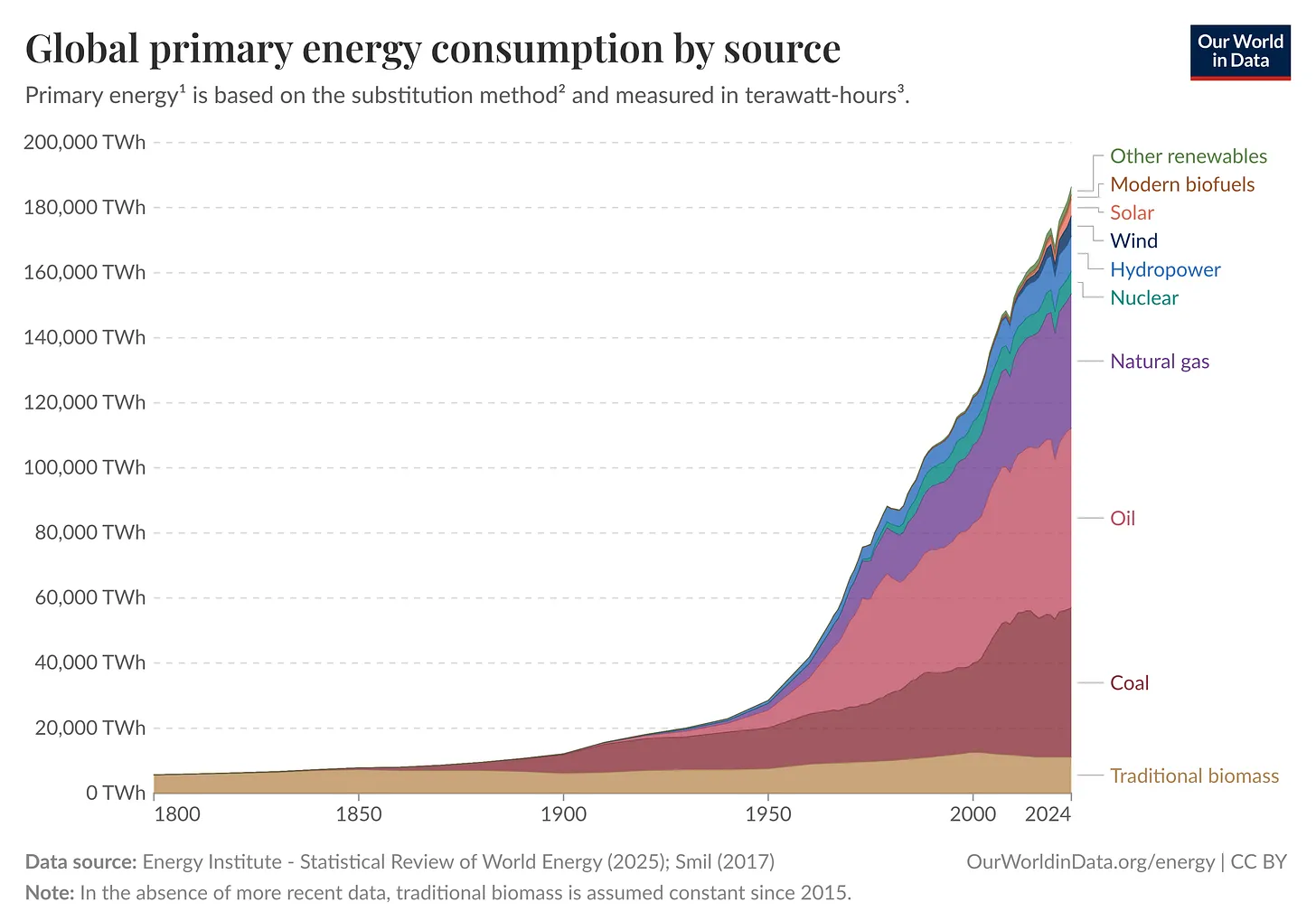

Set aside climate for a moment and ask a simpler question: is continued growth in energy use structurally viable?

The classic de-growth argument says “no” because most modern energy comes from hydrocarbons (oil, gas, coal). These are finite geologic windfalls, so we’re effectively living off photosynthesis from millions of years ago. As those reserves deplete, the claim goes, society must ratchet back to something closer to nature’s replenishment rate.

In the long run, this is a pretty good argument against hydrocarbons! We’ve probably used around 50% of accessible oil reserves and depletion raises extraction effort [1]. The more oil we pump, the more expensive the next marginal oil becomes [2].

The declining EROI (energy return on investment) of hydrocarbons You see depletion most cleanly in oil’s decreasing EROI: how many units of energy you get back for each unit you invest to find, extract, process, and deliver energy [3].

An EROI of ~10 is needed for an energy source to “support complex modern societies.”

An EROI of 3 is the “minimum … value required for a fuel to be minimally useful to society.”

In the early 1900s, US oil wells had an EROI of 100-1000.

Today, US oil wells have an EROI of ~10.

US shale (fracking): ~7.

Canada’s tar sands: ~5 [4].

Corn ethanol: 1.0 - 1.7 (it’s not very efficient to burn oil in tractors and on fertilizer to grow a plant you turn into oil!)

As oil’s EROI decreases below viable levels, natural gas (EROI of ~30 but also falling) will first fill the void, but coal will backstop the system if we don’t build out alternatives [5].

Look at that big bump in coal generation in the mid 2000s :/

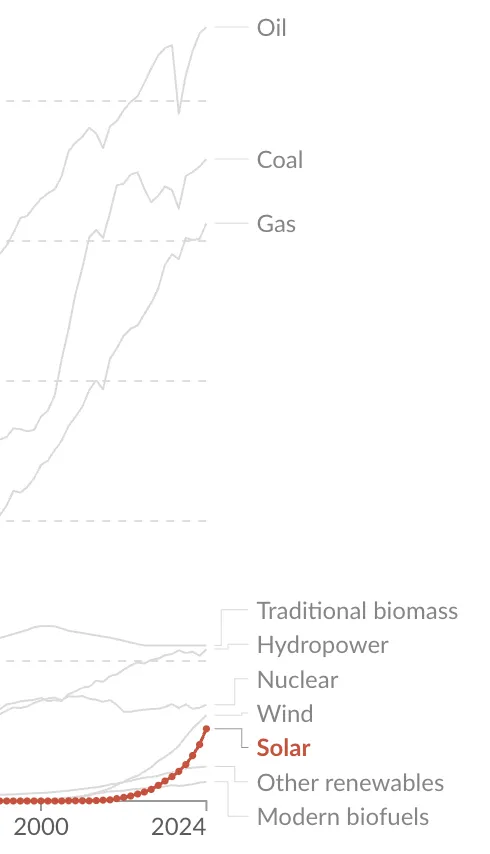

The Increasing EROI of Renewables Renewables aren’t extracted, they’re manufactured [6]. Costs and, in practice, EROI improve with time and scale because factories learn, supply chains densify, and everything is standardized.

Solar PV (photovoltaic) has shown a remarkably stable learning rate for decades. The more panels we build, the cheaper the next watt becomes (independent of commodity cycles). EROI estimates have increased from ~6 in 2005 to ~20 in 2015 and perhaps as high as ~75 in 2025.

Wind rides a similar curve, albeit slower, with steady gains in rotor diameters, hub heights, and capacity factors pushing it to an EROI of ~18 today.

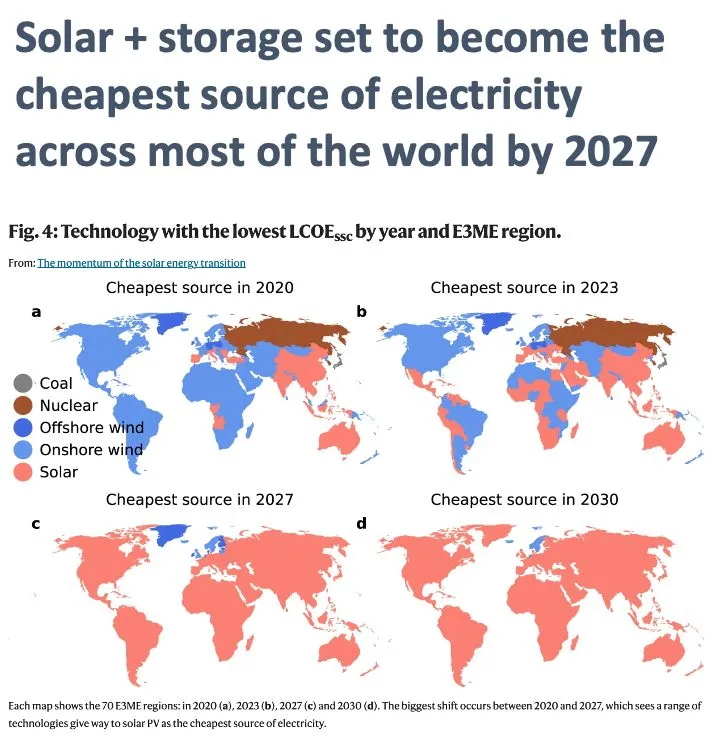

Today, solar (plus batteries to modulate day / night swings) is quickly becoming the cheapest form of electrical generation in nearly every country in the world [7].

Solar’s cost per kWh has been log-linear decreasing for the past 50 years with no sign of stopping.

Now that it’s crossed the cost tipping point, deployment has gone exponential, compounding the increase in EROI even higher.

Notes

[1] “Accessible reserves” are a moving target. America was a declining oil producer (~5m barrels / day) reliant on foreign imports until fracking technology developed. That boosted technically recoverable oil estimates in the US by ~15%, US oil production up 160% (~13.4m b/d), and made the US the ~second largest exporter of oil in the world. If we find a cheap alternative to oil, we might push the price down to the point reserves are no longer economically viable to extract.

[2] The oil supply curve is upward-sloping because early barrels are extracted first. Successive increments come from deeper water, tighter rock, heavier crude, or harsher environments. Each step requires more energy per barrel.

[3] These numbers are annoyingly nuanced to calculate (is the final use electricity?, how far do you have to move the fuel?, how much do you lose in generation? etc) but the numbers make comparisons a lot easier. I’ve chosen the middle of the range from a couple different research papers including one cited above.

[4] The Saudis and Kuwatis still have an EROI of ~90 which pushes the oil world average to 20.

[5] Coal has consistently remained had an EROI of ~45 over the years and also remains extremely abundant (~20% of reserves extracted). Today, China, India, and so much of the rest of the developing world continue to build and rely on the cheap, consistent, large scale generation provided by coal.

[6] You can sort of make an “eventually we’ll run out of everything including the things to make solar panels” argument but that’s basically arguing for total depletion of all the elements on the earth. Solar panels are primarily made of Silicon which is 28% of the earth’s crust by mass! Hydrocarbons (oil, gas, coal) are <0.0001% of the earth’s crust.

[7] LCOE = levelized cost of energy: the net present cost of electricity expected to be generated over the life of the generation facility. I am pretty sure these numbers are unsubsidized.

Standing invitation (inspired by Patio11 who also has some good tips on how to approach this): if you want to talk about hard tech or systems, I want to talk to you.

My email is my full name at gmail.com.

- I read every email and will almost always reply.

- I like reading things you’ve written.

- I go to conferences to meet people like you.

- Meetings outside of conferences are tougher to fit with my schedule - let’s chat over email first. Specificity and being concise makes it easy for me to reply :)